How Blockchain Works?

Technical information Edit

Bitcoin is a peer-to-peer implementation of Wei Dai's "B-money" projects (1998) and "Bitgold" by Nick Szabo (2005). [11]

Blockchain Edit

The main chain (in black) consists of the largest series of blocks from the first mined block, the genesis block (in green), to the last mined block, the current block. Orphan Blocks (in purple) are those that exist outside the main chain. Every 10 minutes, a block containing several transactions is added by a miner to the main chain.

Blockchain ("Blocks Chain") is a distributed database, which has the role of public accounting ledger (balances and account transactions), where bitcoin transactions are recorded. [9] Considered a revolution in the monetary system, because prior to the invention of the block chain, the only way to keep accounting records was centralized and generally non-public databases. It was necessary for people to trust the database to be honest without any malicious changes.

Blockchain technology allows this data to be distributed by all participants in a decentralized and transparent manner. In this way, trust in a third party is no longer needed so that accounting data is correct and not fraudulent.

Each transaction of type "payer X has sent Y bitcoins to the Z recipient" is transmitted to the network through software. Miners verify that the transaction is valid, and if so, add the transaction to the next block in the block chain. Every 10 minutes, a new block is added to the block chain by a miner. The block chain receives the new block containing several recent transactions, including the transaction with the information that the recipient Z now has + Y bitcoins and the payer X has -Y bitcoins.

The blockchain system uses its own unit of monetary account, called Bitcoin. The system does not rely on trust between different users ( network nodes ). Anyone can control and monitor a system node. The bitcoin network works autonomously, without a central database or single central administrator. The chain block is run and maintained collectively by several network nodes peer-to-peer to record transactions and uses encryption to open source to provide basic security functions to certify that bitcoins can only be spent by the owner and to avoid duplicate spending, tampering and database tampering, and is an innovative solution that performs open accounting without relying on a trusted central authority.

Bitcoins transactions are transmitted to other nodes in the network in a few seconds, but are not validated immediately; this happens only after the transaction is processed in the list of time stamps held collectively in the block- book accounting book . This record is based on proof-of-work system (POW) to prevent double expenses.

More specifically, each network generating node looks for all transactions not yet present in the block-chain in a candidate block , a file that among others, [12] has the cryptographic hash of the previous valid block that this node knows. He then attempts to produce a cryptographic hash of that block with certain unique characteristics, an effort that requires enormous computational power and predictable amount of repeated attempts and errors. When a node encounters such a cryptographic solution, it announces the result to the rest of the network, validating the transaction. Pairs that receive new resolved blocks validate them before accepting them by adding them to the block-chain.

Eventually, the block-chain will contain the transaction history and cryptographic property of all bitcoins from the creator address to the last current address. Information registered in a block-chain is incorruptible and immutable; and to reduce the storage space, Merkle Trees are used . [13] Therefore, if a user attempts to reuse currencies already spent ("double spend"), the network will reject the transaction.

Key pairs Edit

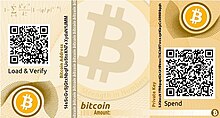

The bitaddress.org site allows the generation of one or more cryptographic key pairs: the bitcoin address (on the left) and its private key (on the right), which are displayed in text and QR code

The bitcoin system works completely differently than the traditional banking system. Many people mistakenly assume by analogy that bitcoins addresses are equivalent to traditional bank accounts and that bitcoin wallets equate to pocket wallets. However, the basis for the understanding of the bitcoin system is the knowledge of public key cryptography , in which two cryptographic keys, one public and one private, are generated. [14]

One of the keys is secret (the private key) and the other is public (the public key, distributed in the form of a bitcoin address). Although different, the two parts of this pair of keys are mathematically linked.

Example of a cryptographic key pair:

- Private key: 5KGLdFwZFJtkr3XGGZFTSd475j7CxjbJSkZXyxi54sGnBWjd8Kc

- Address (derived from public key): 1PWpSxQEGF1LpV6uomdDmzH7qSsCX7ThUJ

Private Key Edit

A bitcoin address is always created in conjunction with your private key. That is, the creation of bitcoin addresses always involves the generation of a pair of keys, a public key (the public address) and a private key (the private key). For each address created, there is a single private key associated with it, which would be the equivalent of a "password". The private key is required to be able to do (subscribe) transactions by spending the bitcoins associated with the address associated with it. Addresses' private keys are usually represented by a random sequence of numbers and uppercase and lowercase letters. A private key is 51-52 characters long, and starts with five (5), L or K.

- Example of private key (from a bitcoin address): 5KGLdFwZFJtkr3XGGZFTSd475j7CxjbJSkZXyxi54sGnBWjd8Kc

For example, if the block string contains the information that the public address 1PWpSxQEGF1LpV6uomdDmzH7qSsCX7ThUJ has 10 bitcoins associated with it, who owns the private key 5KGLdFwZFJtkr3XGGZFTSd475j7CxjbJSkZXyxi54sGnBWjd8Kc can create valid transactions that spend the bitcoins associated with that address because it will have all the necessary information for sign the transaction.

Having the private key in hand, it is easy to find out the associated public address. However, having the public address in place, it is extremely difficult to discover the associated private key.

Public Key and Address bitcoin Edit

The public key corresponds to the key that is openly distributed to receive payments. It can be uncompressed or compressed.

- Public Key Example:

Public key (uncompressed, 130 characters [0-9A-F]): 042C3B22E94A3285A1C621B2EEC86C36A8C4F2AD1ADD84179E4373F5E4FC6896C163108E6175DA9C3DBBB52BD9BD2A7B50C0E9BA7689D3DC7A3AEF4366C84073FC

Public key (compressed, 66 characters [0-9A-F]): 022C3B22E94A3285A1C621B2EEC86C36A8C4F2AD1ADD84179E4373F5E4FC6896C1

To facilitate distribution and reading, bitcoin addresses are derived from public keys. They serve as identification of the sender and recipient for the transactions (payments). They are usually represented by a random sequence of numbers and uppercase and lowercase letters. An address is usually 33 characters in length, but that number may vary more or less.

- Examples of bitcoin address:

Bitcoin address (not compressed, derived from the public key used in the example above): 19fWW9Pq5knHTKErjdrebprQdPLkGTjpVQ

Bitcoin address (compressed, derived from the same public key): 16AzM7BuUh9s6787zaHKh9QFUbyUapKkKP

Addresses are not equivalent to bank accounts. Each address contained in the block chain has or has at least some amount of bitcoins associated with it.

Generating key pairs Edit

A person can create as many addresses as he wants, unlimitedly, quickly and free of charge.

Although there are a maximum number of bitcoins key pairs that can be created, this number is huge.

Addresses can be generated in different ways: through software, website, mathematical calculations, etc.

It is important to note that the person who generated the address had prior knowledge of the private key. That is, if it was not the user himself who generated his own address, he must trust that the other person / company that generated his address will not use the private key to steal his bitcoins.

Because a bitcoin address can exist without ever having a bitcoin associated with it, it is possible to generate key pairs on devices without an internet connection. Offline generation provides greater security by allowing the user to store private keys from their addresses without ever having to contact an online device that may be subject to hacker attacks.

Storage of key pairs Edit

Technically, it is incorrect to say that someone stores or stores bitcoins in their wallet, because bitcoins never leave the block chain. What is actually stored in the bitcoin portfolios are the address pairs and their respective private keys.

When they are generated, the addresses are not automatically included in the block chain of the bitcoin network. A newly created address will only be added to the block chain if it is part of a transaction in which it is defined as the recipient address. In this transaction, the new address will receive bitcoins that are bound to a sender address.

Before and after being used in transactions, addresses and their private keys are stored on the user's device (wallet application, hardware or paper portfolio) or a third party device (in the case of exchanges).

Transactions Edit

QR code example, a two-dimensional bar code that can contain text information. In the Bitcoin system, they usually contain a bitcoin address, which is used to request payments. The QR code can also include the value of the transaction.

The transfer of bitcoins in the bitcoin network occurs through transactions between the sender address and the recipient. In general, these addresses belong to different people, but it is possible for a user to create a recipient address for themselves by doing a self-transfer of bitcoins.

Basically, the process involves three parts: receiving the recipient address, creating the transaction, transmitting the transaction.

Initially, the user who will make the payment needs to know the recipient address. The user who receives the payment can inform you through text, or, more simply, through a QR-type barcode , which will be scanned by the paying user's device.

The payer user portfolio program will create the transaction. To create a transaction, the user only needs to enter the amount of bitcoins he wants to send and the destination bitcoin address.

To transmit the transaction to the bitcoin network, the user only needs to connect briefly to the internet. You can not cancel or reverse a transaction after it has been sent over the network. To have the bitcoins associated with your home address, the recipient does not have to be online at the time of the transaction and does not have to confirm it.

Detailed transaction handling Edit

In the bitcoin protocol, each transaction requires at least three cryptographic keys:

- A sender address (public key)

- The private key of the sender address (secret key)

- A recipient address (public key)

When making transactions in the wallet applications used on a day to day basis, the user only needs to enter the recipient address because the sender address and private key are already stored on the user's device.

The nickname for bitcoin is different from traditional bank accounts because the owner and the account number are not in any central database. Any participant in the Bitcoin network has a digital portfolio that creates an arbitrary number of public / private key pairs. The private keys of the bitcoin wallet are private passwords used to authorize payments, exclusively by the owner of the currency. Bitcoin addresses are generated by the wallet by an arbitrary cryptographic process. Bitco's wallets and addresses do not have any personal information about their owners and are considered anonymous. [15]

Creating new addresses for a single use can help with privacy protection as you will not need to expose your old addresses and associated transactions in order to proceed with the transaction.

Any user can check the block chain directly and observe the transactions almost in real time; there are a number of sites that facilitate this monitoring, including aggregate variables such as number of bitcoins in circulation, number of transactions per hour and transaction rates at each time point, and graphical representations for audits.

If a user wants to operate anonymously on the network, it is essential that the user take preventative measures to hide their IP address in order to obtain maximum privacy while surfing the internet and not to make public their real identity and their bitcoin addresses on the internet. On the other hand, bitcoin exchange sites and trades can associate real identity with bitcoin addresses to provide services. For this reason, some authors prefer to classify Bitcoin as pseudo-anonymous instead of anonymous. Bitcoin's popularity grows rapidly and in the same proportion malicious actions: there are already viruses , trojans , phishingsand scams in the bitcoin trade. As a precaution, it is worth strengthening all the browser security settings.

Bitcoins contain the public key (address of the portfolio) of the current owner. When user A transfers bitcoins to user B, A transfers ownership of the currency by adding user B'saddress in the wallet and authorizes the transfer by signing his or her own private secret key [16] , user's wallet A then communicates this transaction to other nodes in the peer-to-peer network . The rest of the network nodes validate the cryptographic signatures and the amounts involved before registering the transaction in the blockchain.

Posse Edit

Simplified chain of ownership. In fact, a transaction can have more than one input and more than one output.

Ownership of bitcoins implies that a user has the ability to spend bitcoins associated with a specific address. To do this, the buyer must digitally sign the transaction using the private key corresponding to their address. It is not possible to sign a transaction (and spend bitcoins) without previously knowing the private key of the address. The network checks the signature using a public key. If the private key is lost, the bitcoin networkwill not recognize any other evidence of possession; and bitcoins linked to the address will become unusable, meaning they will be effectively lost. For example, in 2013 a user said he lost 7,500 bitcoins, which amounted to 7.5 million dollars at the time, when he threw away a hard drive from his computer, which contained his private key. [17]

Portfolios Edit this page

A bitcoin wallet stores the information that is needed to make transactions with bitcoin. Although the portfolios are often described as a place to save, load or store bitcoins, [18] [19] However, due to the nature of the system, the bitcoins are inseparable from the record of blockchain, ie, they never go out of it. Perhaps a better way to describe a portfolio of bitcoins is as something that "stores the digital credentials that allow you to use your bitcoin funds" [19] .

Since Bitcoin technology uses public key cryptography , in which two cryptographic keys, one public and one private, are generated [14] , the best analogy for a portfolio would be a key chain, that is, a collection of secret private keys and their respective bitcoin addresses).

There are several types of portfolios, which are usually divided into subgroups:

- Physical wallet: Uses some kind of physical storage of private keys. Example: Paper wallet

- Hardware wallet: It is a type of physical wallet that uses some electronic device. Example: Jeff Weiner

- Wallet software: A computer, smartphone or tablet application that is used to make transactions.

- Portfolio Service: An internet service that stores the keys to the user. Example: Blockchain.info, Circle, Coinbase, exchanges.

- Offline wallet: Any type of wallet that never connects to the internet.

The physical portfolios are the safest portfolios because they offline store the necessary credentials to spend bitcoins them, making it difficult to hacking. [19] Some examples include physical coins with the credentials printed on it, [20] made of materials such as metal, wood or plastic. Others are simple paper prints.

Trezor hardware portfolio . This device stores the private keys and never accesses the internet, making it impossible to attack by hackers.

The hardware portfolio is a special kind of physical portfolio. It is nothing more than an electronic device that stores the private keys offline, that is, the device never connects to the internet. However, the device can be connected to a computer, smartphone or tablet, allowing the creation of transactions that use the bitcoins linked to the private keys stored inside. [21]

The portfolio of software connect to the network, store the credentials (keys) that prove ownership of bitcoins and enable the realization of transactions. [22] The Internet service called online portfolios , as Blockchain.info , Circleor Coinbase offer similar features, but may be easier to use; most of the bitcoin credentials are stored with the online wallet provider rather than on the user's device. [23][24]

Reference Implementation Edit

The first portfolio software is called Bitcoin Core and was released in 2009 by Satoshi Nakamoto , the inventor of Bitcoin. It is an open-source program , and was originally called bitcoind. [25] Sometimes called a "Satoshi client", it is also known as the reference client (implementation) because it serves to define the bitcoin protocol and acts as a standard for other implementations. [22] In version 0.5, the client stopped using the wxWidgets UI toolkit and started using Qt software, and the new package became known as Bitcoin-Qt. [22] After the release of version 0.9, Bitcoin-Qt changed its name to Bitcoin Core.[26]

Units Edit

The unit of account of the Bitcoin system is bitcoin. The symbols used to represent bitcoin are BTC, XBT and

On October 7, 2014, the Bitcoin Foundation announced a plan to enter the bitcoin for an ISO 4217 currency code , and mentioned the BTC and XBT as the main candidates. [29]

Offer Edit

Currently, the miner who discovers a new block receives as reward new (newly created) bitcoins and transaction fees included in that block. [30] since November 28, 2012, [31] the reward includes 25 bitcoins new (newly created) for each unit added to the chain blocks (blockchain). In order to redeem your reward, a special transaction called the coinbase is included by the miner along with the payments he has processed. : ch. 8 All circulating bitcoins can be traced retrograde until their respective transactions coinbase. The bitcoin protocol specifies that the reward for each added block will be decreased by half every four years on average. In view of this, it is estimated that in the year 2140, when the arbitrary limit of 21 million bitcoins produced will be reached, the reward will be completely removed, and thereafter miners will receive only the transaction rates of the block as a reward for your work. [32]

Mining (bitcoins generation) Edit

The Bitcoin network creates and distributes a new batch of bitcoins approximately 6 times per hour randomly between participants who are running the coin mining program. Any participant has a chance to win a lot while running the mining program. The act of generating bitcoins is commonly called "mining" (as in "mining gold" [33] ). The probability of a certain miner gaining a lot depends on the computational processing power with which he contributes to the bitcoin network relative to the processing power of all the others combined. [34] The amount of bitcoins generated per batch never exceeds 50 BTC, and this value is programmed in the bitcoin protocol to shrink over time, so that the total bitcoins created will never exceed 21 million BTC.[15] By reducing this premium, it is expected that the motivation to run the generator node (computer running a mining program) will change to receiving transaction fees .

All network mining nodes compete to be the first to find a solution to a cryptographic problem involving their block candidate in the block chain, a problem that requires computational power and repeated attempts and errors to be solved. When a node encounters such a cryptographic solution, it announces to the other nodes in the network and claims a new award in bitcoins. Pairs upon receiving a newly resolved block validate it before accepting it and include it in the block chain block. Nodes use their CPUswith the default client, and third-party clients are also able to use GPUs . [15] [35] [36] Miners can also join together in mining groups (collectively known as "pools") and mine collectively.[37]

In order for the network to generate a new block every 10 minutes on average, each node separately resets the difficulty level of the crypto challenge every two weeks in response to changes in the collective processing power of the network. [ citation needed ]

Currently, bitcoins mining is a highly competitive area with specialized hardware sold in the market. With the increasing difficulty of cryptographic challenges, it has become economically unfeasible to use CPUs for mining (because the electrical energy consumed costs more than the reward in bitcoins generated), and future GPUs will also become completely obsolete for that purpose. For this reason, several miners also started using specific application-specific integrated circuits (ASICs) for bitcoins mining. Some companies market ready-to-mine ASIC systems priced between $ 250 and $ 2500. [38]

Transaction fees Edit

Bitcoin users can optionally pay a small fee on each transaction. This will cause the transaction to be processed with higher priority by the miners, increasing the likelihood that it will be included more quickly in the block chain. [39] Miners have the ability to choose which transactions they will process, and generally prioritize those who pay the highest rates. Rates are based on the transaction size of the transaction generated, which in turn depends on the number of inputs used to create the transaction, not on the value being transmitted. In addition, transactions with older non-expended inputs also receive priority. [40]

Transaction rates are one of the incentives for miners to run "us" miners, especially when the difficulty of generating coins grows or the size of the reward for resolving a block decreases over time. "We" miners collect transaction fees associated with all transactions included in their candidate block [15] .

fungibility Edit

Fungibility is the attribute belonging to movable property that can be replaced by others of the same kind, quality and quantity.

The portfolios and other softwares administer the bitcoins in an equivalent way, establishing a basic level of fungibility.

However, researchers have shown that since the history of each bitcoin is registered and publicly available in the block chain registry, some users refuse to accept bitcoins from controversial transactions (eg from theft), which could be harmful for bitcoin fungibility. [41] Projects like Zerocoin and Dark Wallet seek to address these issues of privacy and fungibility. [42] [43]

Economy Edit

Bitcoin is one of the first implementations of the concept called decentralized cryptomeo , originally described in 1998 by Wei Dai in the discussion list Cypherpunk [44] . Although it has only digital format, a bitcoin is still considered an asset , in the economic sense of the term.

Bitcoin's economy is still small compared to the traditional financial system and official software is still in the beta stage . Meanwhile, real estate services such as music, electronics, real estate, vehicles and hotel services, restaurants and software development in various parts of the world are already being negotiated. Bitcoins are accepted for both online services and tangible goods. [45]Many organizations and associations currently accept donations in bitcoins; among many we can mention the Electronic Frontier Foundation , Free Software Foundation , Wikimedia Foundation , Mozilla Foundation , Internet Archive ,Freenet , The Pirate Bay , WikiLeaks and Singularity Institute . [46] [47] Multinationals Microsoft , Dell , Time Inc. , Dish Network , Virgin Galactic and Reddit , among others, accept payments in bitcoin. Paypalannounced in September 2014 that it intends to accept them. Many traders make exchange between normal currencies (including US Dollars , Euros , Russian Rubles , Japanese Yensamong others) and bitcoins through exchange sites. [48] [49] Any user can check the blockchain directly and observe the transactions almost in real time ; there are several websites that facilitate this monitoring. [50] [51] But as the addresses say anything about their owners would not be easy to identify who sent and who received the coins.

Purchase Edit

Bitcoins can be bought and sold both online and offline . Users of online exchange services conduct bid and ask bids. The use of an online exchange service entails some risk, since such services are subject to bankruptcy, or are hacked, taking with them the bitcoins of clients in their custody, and there are records of the occurrence of both situations.

There are self-service terminals for bitcoins (ATM), which allow the exchange of real in kind by bitcoins and vice versa. The most popular service that provides the worldwide location of ATMs is provided by Coindesk.

A very expected evolution by the community is the advent of the decentralized trustless exchange , that is, it does not require trust between the parties transacting. There are two initiatives at an advanced stage of development, but not yet available:

- bitsquare.io : free software that allows P2P exchange with the presence of a mediator referee with known reputation.

- Coinffeine : startup that promises P2P exchange without the need for arbitrator, by means of deposit in guarantee greater than the value of the parcels in which the exchange is divided.

Monetary differences Edit href = Edit

Unlike regular currency, Bitcoin stands out for its superior technological properties and net neutrality, no administrator or programmer can control the issue (causing inflation and deflation) of bitcoins due to its decentralized nature, [52] [53] softening possible instabilities financial problems caused by central bank economic policies as in the economic crisis in Cyprus.

Unlike central banks , the blockchain system implements a set of rules that govern the Bitcoin network. The rules are determined by open source governance . These rules are written by programmers in open-source protocols auditable by everyone, but they are not self-executing. For the rules to be valid it is necessary to create a social consensus where at least 51% of users (bitcoin wallets) must accept the rules, but these rules can be rewritten and changed at any time if there is a consensus in the community that the rules should be changed. There is an inflation programmed in theBitcoin that adjusts the issuance of new currencies, but because it is a fully auditable open source, inflation is predictable and public knowledge. [33] The issuance of new bitcoins therefore coins can not be manipulated or overshadowed to change users' purchasing power. However, large speculative movements of supply and demand can cause their value to suffer oscillation in the foreign exchange market.

Bitcoin transactions are processed within the peer-to-peer network without the need for a financial processor as an intermediary between network participants. Transactions between the crypto-coins have no intermediary, therefore, reversals are impossible. The bitcoin portfolio transmits transactions to the network nodes that continue to spread the payment information over the rest of the network. Corrupted or invalid transactions are rejected by network nodes. Transactions are virtually free except for the small optional transaction fee that is used to prioritize processing. [33] Conversion of fiduciary coins to bitcoin and vice versa is done on exchange sites bitcoin.

The total number of bitcoins generated tends to 21 million over time. The supply of bitcoins grows as a geometric progression every 4 years; half of the total supply will have been mined by 2013, and 3/4 will have been mined by 2017. By this time the value of bitcoins will likely begin to suffer price deflation (increase in real value) due to the scarcity of currencies in the market demand and lower supply) and reduction of mined coins. However, Bitcoins are divisible by at least 8 decimal places (making a total of 2.1 x 10 15 units), removing practical limitations in downward adjustments in the bitcoin price in an inflationary environment (reduction of purchasing power).[15] Rather than relying on the mining incentive to create new bitcoins, it is expected that we miners during this period will rely on their ability to collect transaction fees. [33]

Results Edit

Failure hypotheses for bitcoin include: vulnerabilities not yet discovered in the protocol, currency devaluation due to declining demand, repression by a global financial authority. The exchange sites bitcoin may suffer repression by the local government. However, it would probably be impossible to "ban all crypto-coins around the world". [54] Decentralization, internationalization and anonymity incorporated into bitcoin seem to be a reaction to lawsuits against centralized digital currency companies such as E-gold and Liberty Dollar . [55] In an investigative article The Irish Times, Danny O'Brien reported, "When I show this bitcoin economy to people, they ask, 'Is that legal?' They ask, 'Is it a blow?' I guess there are a lot of lawyers and economists out there trying to answer those questions. I suspect we might include lawmakers on that list soon. " [54] In February 2011, Slashdot coverage and the subsequent Slashdot effect affected the value of bitcoin and the availability of some of the related sites [56] [57] .

Chronology Edit

2008-2009 Edit

- In 2008, Satoshi Nakamoto published a scientific article on the The Cryptography Mailing List [58] list describing the bitcoin protocol. [33] [59] [60] [61]

- In 2009, the bitcoin network begins to work with the launch of the first bitcoin open source client and the issuance of the first bitcoins. [59] [62] [63] [64]

2010 Edit

- The initial price of bitcoins was set by people on the BitcoinTalk forums. Initial transactions included, for example, the purchase of one pizza per 10,000 BTC. [59]The Mt.Gox site , a kind of bitcoin exchange market, begins operations.

- On Aug. 6, a severe vulnerability in the bitcoin protocol was discovered. Not properly verified transactions were included in the transaction log (" blockchain "). Taking advantage of the flaw, users could issue for themselves unlimited amounts of bitcoins, violating the currency's economic constraints. [65] [66]

- On August 15, there was the first case of users taking advantage of the newly discovered vulnerability. More than 184 billion bitcoins were generated in a single transaction and sent to two different addresses. In a few hours the vulnerability was corrected with the release of a new version of the protocol; the adulterated transaction, in turn, was located and removed from the transaction log. This was the only case in the bitcoin history of a major security breach exposed and used for fraud. [65] [66]

2011-2012 Edit

- In June 2011, Wikileaks [67] and other organizations started accepting bitcoins as a form of donation. Among these organizations was initially the Electronic Frontier Foundation , which shortly afterwards reversed the ruling, citing concerns over the lack of legal precedents of the new currency. [68]

- At the end of 2011, the price of bitcoin plummeted from $ 30 to below $ 2.00, an event that many consider a "bubble burst." Some believe that the sudden drop was due to the increasing computational power and consequent cost reduction (of hardware and electrical energy) to produce bitcoins (an activity called bitcoin mining ). [69]

- In October 2012, BitPay announced that there were over 1000 merchants accepting bitcoin as a form of payment. [70]

- In November 2012 WordPress began accepting transactions with the bitcoin currency. [71]

2013 Edit

February Edit

- The Coinbase payment system announced it had sold more than $ 1 million in bitcoins in a single month, with bitcoin trading above $ 22.00. [72]

- The Internet Archive announced that it would accept bitcoins as a form of donation; in addition, it would also offer its employees the chance to choose to receive part of their wages in bitcoins. [73]

March Edit

- The transaction log (" blockchain ") was temporarily divided into two independent logs governed by separate rules. The bitcoins exchange site Mt.Gox has stopped accepting new bitcoins deposits briefly. Bitcoin quotes fell 23% to around $ 37.00 [74] [75] , returning to the previous level (about $ 48.00) after a few hours. [76]

- In the United States , FinCEN has created regulations for "virtual currencies" such as bitcoin, framing the country's bitcoin miners in a specific financial category ("Money Service Businesses") that may be subject to legal obligations government. [77] [78] [79]

- OKcupid started accepting transactions with the bitcoin currency. [80]

April Edit

- Customers of payment sites BitInstant and Mt.Gox suffered delays due to increased demand for bitcoins, with consequent increase in quotations. [81]

- On the 10th, bitcoin's price plunged from $ 266 to $ 105. Six hours after the fall, the currency recovered part of its value, being quoted at $ 160. [82]

August Edit

- The German Finance Department authorized the use of money in private financial transactions. If companies wish to use Bitcoin, they should request permission from the Federal Financial Supervisory Authority. Bitcoin will not be classified as a real currency in the country, but rather as a unit of account.

November Edit

- Record. On November 17, 2013 Bitcoin's quotation surpassed US $ 1216.7313. [83] The appreciation of Bitcoin is due to the movement of the Chinese market in BTC China, which currently occupies the first place among the Bitcoin exchange sites, occupying the place that was the MTGox. Bitcoin's buying volume is already the biggest ever, but it is not surprising, since China has about 1.351 billion people (2012).

2014 Edit

Satoshi Nakamoto Edit

Satoshi Nakamoto is the pseudonym of the person or group that created the original bitcoin protocol in 2008 and launched the bitcoin network in 2009. In addition to the bitcoin itself, no other reference to that identity was found. Its involvement in the original protocol seems to have ended in mid-2010. [59] Citation error:

</ref>Missing closure element for element<ref>Identity Edit

Several newspapers, such as The New Yorker and Fast Company tried to find the true identity of Satoshi Nakamoto. The investigation of Fast Company suggested there be a link between a patent of encryption required by Neal King, Vladimir Oksman and Charles Bry on August 15, 2008 and the registration of domain bitcoin.org made 72 hours later. The patent application ( # 20100042841 ) contained technology similar to that of bitcoin. At least one identical phrase was found both in the patent application and in the document describing bitcoin. The three men involved in the patent petition explicitly denied being Satoshi Nakamoto. [84] [85]

The Bifurcation of March 2013 Edit

On March 12, 2013, a bitcoin server (also called a "miner") running the latest version of the protocol created a too large record in the transaction log (also called "blockchain"), incompatible with earlier versions of the protocol due to its size. This created a split in the transaction log. Some users were using the latest version of the protocol, which is compatible with longer logs, while other users were still using older versions of the protocol, not using the new log too large. This bifurcation resulted in the formation of two different logs without a definite logging consensus, which allowed the same value of bitcoins, represented in two distinct logs, to be used twice. The Mt.Gox site temporarily stopped accepting new bitcoins deposits.[86] Bitcoin's price fell 23% to $ 37 on Mt.Gox, returning to the previous $ 48 price after some time. [74] [75]

Developers at bitcoin.org attempted to resolve the issue by recommending users to revert to an earlier version of the protocol, which used the older version of the common log trunk. User funds have largely remained unchanged and a consensus was established around this decision. [87]

FinCEN Edit

On March 18, 2013, the Financial Crimes Enforcement Network (FinCEN), a US government agency, issued a report on centralized and distributed virtual currencies and their legal status. The report classified digital coins and other forms of payments, including bitcoin, as "virtual coins" because they are not under the authority of any specific government. FinCEN exempted American bitcoin users from any legal obligations relating to the currency, on the grounds that bitcoin is not regulated by FinCEN. However, the body has ruled that any parts that issue virtual coins - which includes bitcoins miners - must obey specific legislation if they sell their virtual currency in exchange for the national currency. [77]

In addition, FinCEN has stated that it has regulatory authority over organizations that use bitcoins as a means of payment or exchange. [78] [79]

The corollary of FinCEN's decision is bitcoin's anonymity breach. For example, in cases of suspicious activity, large bitcoin trading sites would be required to inform the authorities of the investigated negotiations in the same way that traditional financial institutions have to do. [88] [89]

Quotes in 2013 edit

The dollar quotation for a bitcoin grew by an order of magnitude, rising from about $ 13 / BTC on 1 January to $ 1000 / BTC on 27 November, just 10 months later. It is speculated that global events such as the European financial crisis - in particular the financial crisis in Cyprus, in addition to positive statements from FinCEN giving greater legal support to the currency - have motivated the increase in the price quotation. [90] [91] [92] [93]

The market value of bitcoin - that is, the sum of all currencies in circulation - has reached the mark of 1 billion dollars. Financial market commentators suspect that bitcoin prices are going through an economic bubble . [94][95] [96] On April 10, 2013, the bitcoin currency fell in six hours, a price of $ 266.00 to $ 105.00, returning to the value of $ 160, 00 within six hours. [82]

Reviews Edit

Criticisms of Bitcoin have been a constant since the beginning of its adoption, and the basis for them varies between actual episodes, market projections and design flaws. Among Bitcoin's critics are former users, technologists, economists, and politicians.

technology Edit

Security Edit

While many consider Bitcoin to be a safe currency because of end-to-end encryption, the risks to which users are exposed outside the network are the focus of the problem. Since access to the funds of an account depends solely on possession of a secret key, online wallet funds can be hacked [97] [98] , and offline wallet funds share the same insecurities of cash and bonds to bearer (credit notes). [98]

In February 2014, foreign exchange company Mt. Gox filed a bankruptcy lawsuit in Japan 4 days after its website went offline because of an internal crisis stemming from the theft of more than half a million bitcoins from its customers due to a security breach .

In addition to the possibility of theft, funds can simply be lost and become orphans at the time the secret key holder loses possession (memory corruption, destruction, or physical key loss). [99] In this case, there would be no means of regaining possession of the key and, consequently, of the funds.

Irreversibility Edit

The irreversible nature of the transactions in Bitcoin generate mistrust and increase its factor of insecurity. Although the speed of confirmation of a non-taxable transaction is a positive point, since the funds transferred to a public key will be confirmed possession of the holder of its equivalent secret key in the next blockchain update, in the case where the payer does not receive the good for which he has paid, the transaction can not be undone and the payer is impaired. [99]

Another case where irreversibility is undesirable is in the case where the transaction values, such as the quantity of bitcoins and the public keys involved, are incorrect. In this case, the amount of Bitcoins transferred may be larger than desired, or bitcoins may be transferred to the wrong public key (recipient) funds.

Proposed solutions are the collateral services developed on the Bitcoin platform, but the involvement of third parties diminishes end-to-end security, and is also criticized.

Scalability Edit

The operation of the Bitcoin network depends on the occurrence of a very limited number of actions regarding the creation of new nodes, manufacturing of transactions, mining of coins, proof of work and establishment of consensus. However, it is a growing view that the Bitcoin network as originally deployed is not scalable.

In creating new nodes, the copy of the blockchain, ever growing database, is the main step. However, its growth has outpaced the growth of data transfer rates and storage capacity. To curb this growth, the blocks of the same had limited maximum size, which also limits the number of transactions per period (10 minutes). [98]Although this does not represent the immediate end of Bitcoin, micropayments and exempt transactions are being less and less processed, eventually expiring.

The debate between raising or maintaining the maximum size of the block of transactions per period has divided the community involved in the project and generated controversy. [100] Those who defend the increase argue that maintenance is hampering the reliability of network transactions, and maintenance advocates argue that the increase would reduce the number of miners, generate network centralization, and not solve the problem. scalability problem of blockchain size. The groups that defend each side have created competing versions known as Bitcoin Core and Bitcoin Classic.

Centralization Edit

One of the main directives of the Bitcoin project is decentralization. Criticisms about certain aspects of Bitcoin, however, concern elements of centralization in it. Although the architecture of the network maximizes the decentralization in the nodes, the need for labor proof guarantees a greater influence to the nodes with greater specific processing power in the mining stage. Coupled with the large-scale use of ASICs by the new generation of miners, only a select group of individuals controls the creation of new Blockchain blocks. With the possible increase of the maximum size of the block proposed by the Bitcoin Core version, this centralization would become even greater. [100]

Another form of centralization that is criticized for the Bitcoin project is the process of making design decisions. Although the process for suggesting new modifications to be made in the code is open to anyone who wants to contribute, the choice of measures to be taken is made by a small group of programmers [100] , who were not elected to that function, nor are the breeder (s).

Economy Edit

instability Edit

Conservative economists have cautioned against applying funds to Bitcoin as a form of investment because of its instability. Although unstable growth can be regulated by the generation of interest in bitcoin investment, an episode of rapid devaluation could mean the total or partial loss of cryptomeda value caused by an episode of panic selling . The consequences of this would be thousands of criptomoeda investors losing their investments overnight, although without losing the possession of their bitcoins. [101]

Among those who raised the issue is former US Federal Reserve Chairman Ben Bernake, who accused the cryptomeo of being highly volatile. [102]

In 2013, there was an 80-fold increase in the 1-bit-pounds value between the beginning of the year and its month of November. However in April 2014 its value was registered below half of the maximum registered 5 months before. [97]

Another reason that causes Bitcoin's instability to generate distrust is that being a stable way of storing value is one of two functions that a currency must play in order for it to succeed, the other function being to serve as a medium of exchange .

Economic Model Edit

Although the total fixed sum model has been one of the main reasons why many have praised and adopted Bitcoin, seeing in it the opposite example of what is done by some governments (with the printing of money and consequent inflation), this design decision is over meaning a decrease in the circulation of money, since many of those who adopted it did so in the hope of profiting from the increase in their value. [97] In addition, when creation of bitcoins ceases, whenever a secret key is lost, or someone uses the blockchain to make a time stamp, the total sum of non-orphaned bitcoins will decrease, decreasing that sum in practice.

Use Edit

The different ways in which you can use bitcoins are still limited, if compared to the dollar or real. [98] This comes from the fact that a higher level of technical knowledge is required for a person to receive criptomoeda-format payments.

Since the number of clients of the currency is small for the large companies, they have maintained their distrust with the acceptance of the criptomoeda as a form of payment. Due to lack of consolidation, Bitcoin has encountered difficulties in being widely used in the payment of services or goods. [99] One possible consequence of this is the reduction of cryptomidea to an intermediate currency, or to a possible investment, in practice. If this is the case, there is a tendency for devaluation.

Speculation Edit

Choosing a ceiling for the total number of bitcoins is also criticized for encouraging speculation. Those who adopted the currency early were part of enrichment stories and served as an example for those interested in obtaining bitcoins waiting for appreciation. [97] In addition, the currency is deflationary (due to the "orphaning" of bitcoins), and has a steady growth trend.

On the other hand, the existence of this strong speculative market poses an undesirable risk to those willing to adopt currency as a means of payment, since it has become extremely unstable and can suffer large value variations between one transaction and another. [99] This fact hampers the consolidation of Bitcoin as currency, since the less interest was in using it as a means of payment, the less people and companies will risk accepting it as a means of payment.

Political Edit

The emergence of Bitcoin initiated a debate on the need and possibility of regulation of values and transactions. While some political figures have demonstrated enthusiasm for cryptomoeda, others argue for the need for regulatory legislation, which may focus on transactions occurring in the network, or the creation of credit guarantee funds for criptomoeda investors.

Regulation Edit

The (intentional) anonymity of the transactions taking place in the Bitcoin network enables the currency to be used as a form of payment in illegal transactions, such as gambling and drug trafficking. [98] Although it is easy to trace the public keys to which a certain amount has belonged since its creation, the same can not be said of the task of associating such keys with the identity of the holders of those portfolios. This feature makes it impossible to tax a large number of transactions on the part of the governments of the different countries for which this value may have traveled.

The need for regulation is not only defended by legislators, but also by those who see in the lack of regulation a reason for not adopting Bitcoin as a currency, since there is no body that offers a guarantee of minimum value to those willing to invest in the currency. Unlike gold, which has the minimum value of raw material for the production of jewelry, and the dollar, which has the minimum value guaranteed by the US government, Bitcoin has no guarantees of value. [101] [99] And a regulatory body that fulfills the role of credit guarantor is considered as the solution to this problem.

Non-Regulation Edit href = Edit

Bitcoin's decentralized architecture is a purposive design choice in order to preclude the internal regulation of its mechanisms by a specific individual or institution. This was particularly appealing to those who viewed antipathy in episodes where the government of a country issued banknotes and gave credit to large corporations with the purpose of preventing them from going bankrupt, to the detriment of the value of working-class reserves and wages. However, the pressure made by government institutions for the existence of fiscalization and taxation can diminish the value attached to the existing bitcoins. [98]However, this is not a possibility because of technological limitations in changing the structure of the network today.

Moral Edit

In addition to the problems and criticisms regarding the Bitcoin project in terms of its capacity as a functional currency, the project also finds it difficult to accept because of the negative possibilities that have arisen with the creation of the criptomoeda.

All transactions on the network are registered with the identification of nodes by their nicknames. A malicious user can use the non-existence of records of his identity in the network for illicit purposes. The use of bitcoins for the payment of black market transactions (such as the purchase of illicit drugs, weapons, etc.) [102] has been an increasingly common practice. In addition, due to the irrationality of transactions, the network has been used in money laundering and tax evasion schemes.

Another illegal practice raised by Interpol is the use of Blockchain to spread illegal content (such as child pornography) or harmful content (such as malware). [103]

Social Edit

In an interview with the online portal The Verge, Bill Gates disregards Bitcoin as an option for the poorest people [104], currently, due to its volatility, and the cost of contracting guarantee services that preserve the funds of the payer, case it makes a mistake in making a payment.

Challenges to criminal Edit

The reports issued by the European Central Bank ( Virtual Currency Schemes - 2012 ), the Financial Crimes Enforcement Network of the US Department of the Treasury ( Application of FinCEN's Regulation to Persons Administering, exchanging or Using Virtual Currencies - 2013 ) and the Federal Bureau of Investigation Bitcoin Virtual Currency: Unique features Present Distinct Challenges for Deterring Illicity Activity - 2012 ) present critical aspects associated with the conceptual nature and transactions involving Bitcoin.

Due to the stringency of European Central Bank rules , bitcoin is not considered to be an electronic currency because it fails to fulfill some of the requirements of the directive governing e-money transactions, the Electronic Money Directive (2009/110 / EC). According to the document, to be considered as electronic money, it is necessary that it has the capacity to be stored electronically, be accepted as a form of payment by institutions other than the one that originated it and be issued based on the receipt of funds in a non- less than the monetary value issued. The two initial conditions are satisfied, unlike the last one, which conflicts with the dynamics of the generation of money, called "mining", which is more like a mathematical competition than a financial transaction. Unlike precious metal miners, such as gold, who find it challenging to find them on rocks or on river beds, Bitcoins deal with data. The entire network is guaranteed and regulated through cryptography [105] .

In the United States , any institution offering foreign exchange or remittance services must be registered as Money Services Business (MSB) with the Financial Crimes Enforcement Network (FinCEN) and implement the money laundering prevention program.

In the case of bitcoin, the end user is not considered MSB and is not subject to the rules of FinCEN . However, the administrator (the one who places and withdraws circulation tickets) and the exchanger (who performs the conversion and exchange between the virtual and the official currency) must, within the borders of the United States, submit to the norms of that institution, even committing to implement the anti-money laundering program. [106]

Bitcoin can become an attraction to criminal activity as it is valued against official currencies and is accepted as a form of payment in various online transactions for the purchase of goods (clothing, games, music) and services (hotels, restaurants) in various parts of the world. [107]

For this reason, and based on reliable sources, the FBI has classified as high the likelihood of cybercriminals misappropriating other non-proprietary bitcoins in individual portfolios or interfering with transaction validation services using malware or computer system intrusions .

The fact that there is no central authority or database, since it is a decentralized network based on P2P, makes it a great challenge for law enforcement officers to detect suspicious activity, identify users, obtain records of transactions and, consequently, , initiate a criminal action. [108]

The complexity related to user identification can be mitigated by the optional (optional) publication in the block-chain of the IP address from which the transaction originated, which will also depend on how the user implements his portfolio, using or not resources to make your position anonymous.

Bitcoin's legal uncertainty leaves users unprotected, as well as being an attraction to criminals, with the intention of misappropriating values (bitcoins themselves), laundering money, and fraudulent transactions.

Suspicious activities Edit

- June 2011: Silk Road sells illicit drugs, accepting payment only through Bitcoins;

- June 2011: Infostealer.Coinbit malware was considered the first to steal Bitcoins from individual wallets;

- July 2011: ZeroAccess botnet ;

- October 2011: Cybercrime offers the sale of ZeuS Trojan botnet, accepting payment at Bitcoins, Liberty Reserve or WebMoney. [109]

- March 2013: Bitcoin wholesale market with facts not yet clarified bitcointalk.org

- February 2014: Mt. Gox collapses and suspends its operations, it is suspected of internal fraud and negligence, causing a loss in 744,408 Bitcoins. Impact affects quotes throughout the BitCoins market.

Comentários

Postar um comentário